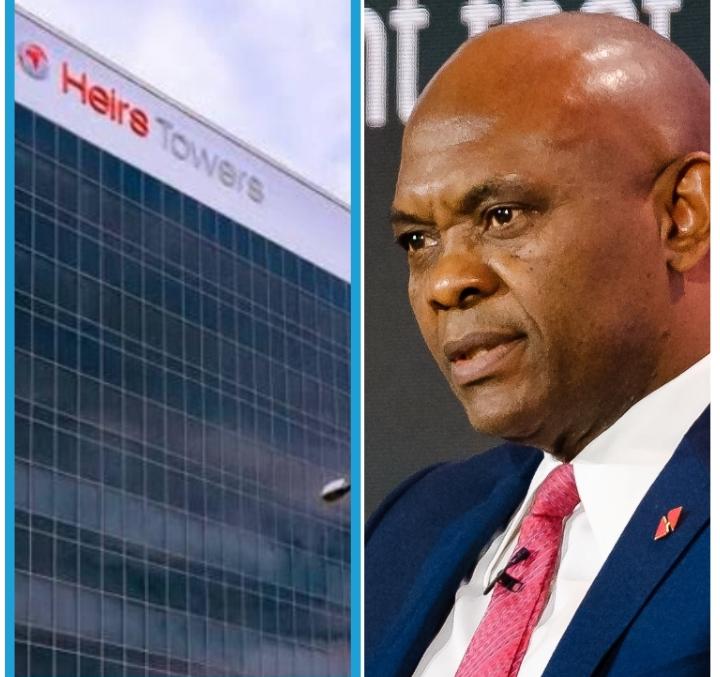

Heirs Energies has acquired the entire 20.07 percent equity stake (120.4 million ordinary shares) previously held by Maurel & Prom S.A. in Seplat Energy Plc (Seplat Energy) at a price of GBP3.05 pence per share, valuing the transaction at approximately $500 million.

The acquisition by Africa’s leading indigenous integrated energy company, according to a report by theeagleonline, was made public in a statement on Wednesday.

It represents a further milestone in Heirs Energies’ long-term strategy to strengthen indigenous participation in strategic assets and accelerate sustainable energy development and security for Nigeria and Africa.

Commenting on the transaction, Tony Elumelu, Chairman of Heirs Energies, said: “This acquisition reflects our strong belief in Africa’s ability to own, develop, and responsibly manage its strategic resources.

“It is a long-term investment in Nigeria’s and Africa’s energy future, and aligns with our mission to drive energy security, industrialization, and shared prosperity.

“Seplat Energy has built a resilient, well-governed platform with compelling long term prospects, and we are pleased to support its continued growth and value creation for all stakeholders.”

This landmark achievement was supported by two leading African financial institutions: Afreximbank and AFC, further demonstrating Africa’s capacity to finance its own deals.

Heirs Energies Limited is Africa’s leading indigenous-owned integrated energy company, committed to meeting Africa’s unique energy needs, while aligning with global sustainability goals.

Having a strong focus on safe operations, innovation driven growth, environmental responsibility, and creating shared prosperity for all stakeholders, Heirs Energies leads in the evolving energy landscape and contributes to a more prosperous Africa.

Heirs Energies operates OML 17 in the Niger Delta, producing over 50 thousand barrels of oil per day (50 kbopd) and 120 million cubic feet of gas per day (120 mmcfd), with reserves base of over 1.5 billion barrels of oil (MMBo) and 2.5 trillion cubic feet of gas (Tcf).

Since its debut in 2021, Heirs Energies has established itself as the brownfield excellence leader, having successfully addressed all the challenges that confronted onshore operations in Nigeria and has been a critical catalyst for the rejuvenation of safe and reliable onshore operations in the Niger Delta.

Heirs Energies is a leading gas producer and supplier into Nigeria’s domestic gas market, providing fuel for over 400 megawatts of electricity generation, powering millions of homes, businesses and factories.

Seplat Energy Plc is a Nigerian independent energy company focused on oil and gas exploration, production, and gas processing, primarily in the Niger Delta.

It is listed on both the Nigerian Exchange and the London Stock Exchange and is a key player in Nigeria’s energy transition.

Seplat Energy has, as at December 31, 2024, 2P reserves of 1.043 billion barrels of oil equivalent (MMBoe) and working interest production 135.6 kboepd as at October 31, 2025.

Adekunle Sotunbo, a public affairs and business analyst, in a Facebook post, throws more light:

“In another power deal that was consummated on the eve of the CGT 30% rate takeoff, Tony Elumelu’s Heirs Holdings buys the total equity holdings of Maurel & Prom SA in Seplat, for $500M. The French company’s 20% stake made them the single largest shareholder in Seplat before this deal.

For perspective, Maurel & Prom SA have held their shares from inception and before the private placement and subsequent IPO, which opened at N570 in 2014. Today, Seplat shares are just over N5,000 per share. Calculate the Capital appreciation for a minute. Imagine the Capital gains tax avoidance of 20% differential on the huge profits made from this transaction. Note that Maurel & Prom SA is a Paris based entity and these funds would definitely be repartriated immediately, so no waiver.”